Everything about 501c3

Wiki Article

Non Profit Organizations Near Me Can Be Fun For Everyone

Table of ContentsSee This Report about Irs Nonprofit SearchAbout Non Profit Organizations Near MeSome Known Facts About 501 C.Indicators on Not For Profit Organisation You Need To Know6 Easy Facts About Nonprofits Near Me ShownSome Of 501 CThe Npo Registration DiariesIndicators on Not For Profit You Need To KnowThe 2-Minute Rule for Nonprofits Near Me

Included vs - not for profit. Unincorporated Nonprofits When individuals think about nonprofits, they usually consider incorporated nonprofits like the American Red Cross, the American Civil Liberties Union Structure, as well as various other officially developed companies. However, several individuals participate in unincorporated not-for-profit organizations without ever before recognizing they've done so. Unincorporated not-for-profit organizations are the outcome of 2 or even more people working together for the function of giving a public advantage or service.Exclusive structures might include family structures, exclusive operating foundations, as well as business foundations. As kept in mind over, they normally do not use any type of solutions as well as rather use the funds they elevate to support other philanthropic organizations with solution programs. Personal structures likewise have a tendency to need even more startup funds to establish the organization as well as to cover legal costs and various other recurring expenditures.

The Basic Principles Of Non Profit Organizations Near Me

The assets stay in the count on while the grantor is active as well as the grantor might manage the possessions, such as dealing supplies or property. All properties deposited into or purchased by the count on continue to be in the trust fund with income distributed to the marked beneficiaries. These trusts can survive the grantor if they consist of an arrangement for ongoing management in the paperwork made use of to develop them.

The smart Trick of 501c3 That Nobody is Talking About

Conversely, you can hire a depend on attorney to help you create a philanthropic depend on and encourage you on exactly how to manage it progressing. Political Organizations While a lot of various other types of nonprofit organizations have a limited capacity to take part in or supporter for political activity, political companies run under various regulations.

The 45-Second Trick For Non Profit

As you assess your alternatives, be sure to seek advice from a lawyer to identify the best approach for your organization and also to ensure its appropriate setup.There are lots of kinds of not-for-profit organizations. All properties and also earnings from the nonprofit are reinvested right into the organization or given away.

How Npo Registration can Save You Time, Stress, and Money.

Some examples of widely known 501(c)( 6) organizations are the American Farm Bureau, the National Writers click to read Union, and the International Organization of Satisfying Coordinators. 501(c)( 7) - Social or Recreational Club 501(c)( 7) organizations are social or entertainment clubs.

The Facts About Nonprofits Near Me Revealed

Common sources of income are membership dues and donations. 501(c)( 14) - State Chartered Debt Union and Mutual Get Fund 501(c)( 14) are state chartered lending institution as well as common book funds. These companies offer financial solutions to their members and the community, generally at affordable prices. Income sources are company activities and also government gives.In order to be qualified, at the very least 75 percent of participants have to be existing or previous members of the USA Army. Financing comes from contributions and also federal government grants. 501(c)( 26) - State Sponsored Organizations Offering Health And Wellness Insurance Coverage for High-Risk People 501(c)( 26) are nonprofit companies created at the state level to supply insurance policy for high-risk people that might not have the ability to get insurance with various other methods.

Not known Facts About Nonprofits Near Me

Financing comes from donations or federal government gives. Instances of states with these high-risk insurance policy swimming pools are North Carolina, Louisiana, as well as Indiana. 501(c)( 27) - State Sponsored Workers' Compensation Reinsurance Company 501(c)( 27) not-for-profit organizations are developed to supply insurance policy for workers' settlement programs. Organizations that offer workers compensations are needed to be a participant of these organizations and pay fees.A nonprofit corporation is an organization whose objective is something various other than making a profit. 5 million nonprofit organizations registered in the United States.

Not known Incorrect Statements About 501 C

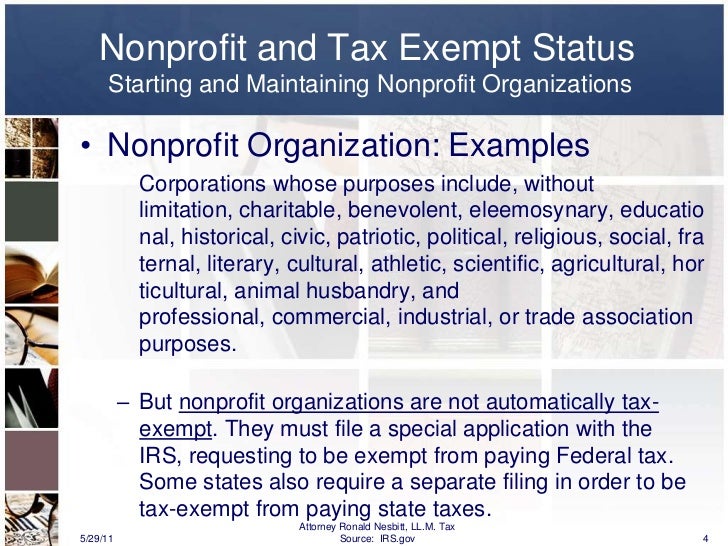

Nobody individual or group owns a not-for-profit. Possessions from a not-for-profit can be offered, yet it profits the entire company instead of individuals. While any person can integrate as a nonprofit, only those that pass the stringent standards set forth by the government can accomplish tax obligation exempt, or 501c3, status.We discuss the steps to coming to be a nonprofit more right into this web page.

Things about Non Profit Organizations Near Me

One of the most important of these is the venmo nonprofit capability to acquire tax obligation "exempt" status with the internal revenue service, which allows it to obtain contributions devoid of gift tax obligation, permits contributors to subtract donations on their tax return as well as spares several of the company's tasks from revenue tax obligations. Tax excluded condition is essential to lots of nonprofits as it encourages donations that can be made use of to sustain the go to this web-site objective of the organization.Report this wiki page